Kamilisha Transaction

This is short term loan for eligible customers enabling them to complete transactions when funds are insufficient when paying for bills or transferring funds on the Co-op Bank App.

This is short term loan for eligible customers enabling them to complete transactions when funds are insufficient when paying for bills or transferring funds on the Co-op Bank App.

Features

-

- Loan Limit from Ksh 1-Ksh 100,000

- Maximum of 30 days

- Salaried and Business customers

Requirements

-

- Open a salary and business account

- Register on the Co-op Bank App to access this service.

How to Opt in to Kamilisha Transaction Loan

- Dial *667# or *557# o

- Select E-loans

- Select Opt-in

- Read & Accept terms and conditions here

- Confirm Opt-in – (The limit to be marked when the customer opts in and to be refreshed in 30 days.

How to opt out

- Dial *667# or *557#

- Select E-loans

- Select Opt-out

- Confirm Opt-out

More Information

-

This is a Co-op Bank overdraft service that allows you to complete transactions when you don’t have enough money in your bank account. It bridges the shortfall amount between what you have and what you need to pay, helping you complete important transactions instantly.

-

The service is available to both individual retail customers and business customers who:

- Are registered on Mobile banking platform.

- Have an active Co-op Bank account.

- Have opted into the service.

- Meet our eligibility requirements.

-

Getting started is simple and can be done through the following mobile banking channels:

- USSD Journey:

Opt-In

- Dial *667# or *557#

- Go to E-Loans menu

- Select “Kamilisha Opt In”

- Read and accept the terms and conditions

- Confirm opt-in.

Opt-Out

- Dial *667# or *557#

- Go to E-Loans menu

- Select “Kamilisha Opt Out”

- Confirm opt-out.

Once you opt in, Kamilisha limit becomes active immediately and you can start using it right away.

- Web/Mobile App Journey:

Opt-In

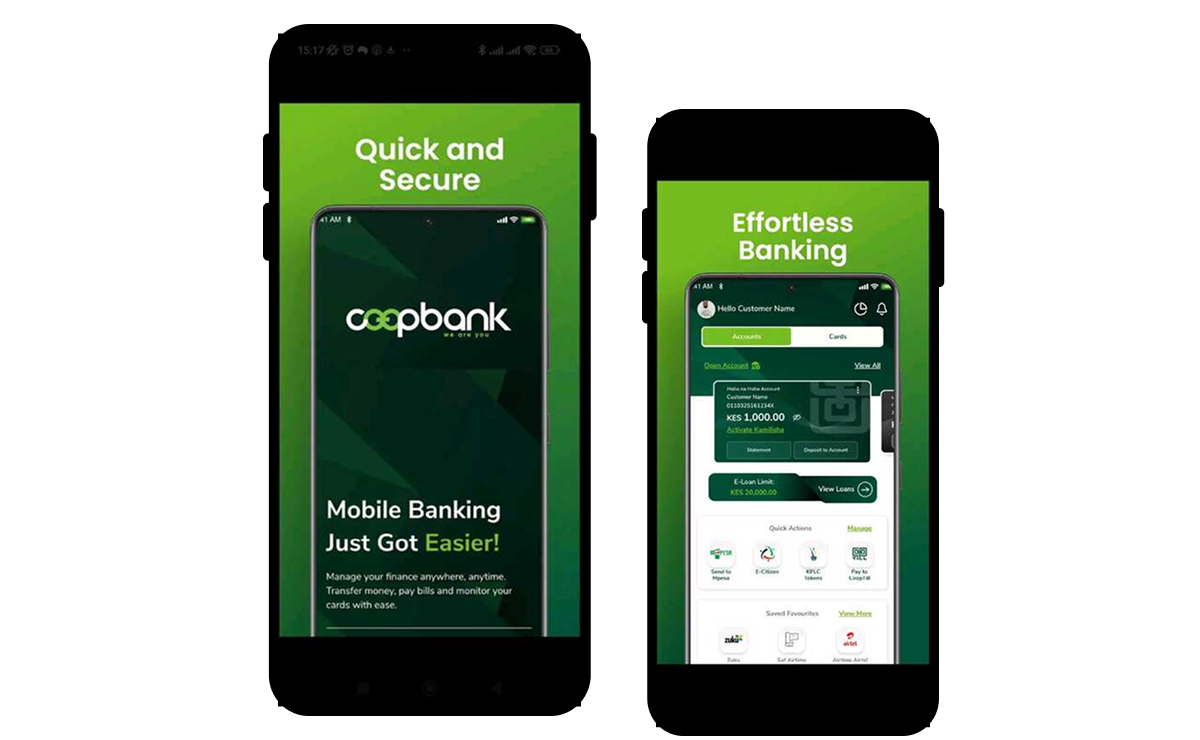

- Log into Mobile banking platform.

- Navigate to Home page > Accounts section

- Locate “Activate Kamilisha” option on account card and click on it.

- Read and accept the terms and conditions

- Confirm opt-in.

Opt-Out

- Log into Mobile banking platform

- Click “More” (3 dots) on account card

- Select “Opt-Out Kamilisha”

- Successful opt-out confirmation

-

Your Kamilisha limit is personalized based on your banking activity with Co-op Bank. We review your account transactions, salary deposits, or business turnover to determine what you qualify. To increase your limit, maintain active account usage and repay your Kamilisha balance on time.

-

Your limit is refreshed monthly based on your account activity, repayment history, and eligibility criteria. Good transaction patterns and timely repayments can help you qualify for higher limits.

-

Yes, you can use Kamilisha as many times as you need within your approved limit. The service supports multiple withdrawals within 30 days of your first use for salaried customers and 15 days for business customers if you utilize within your approved limit.

-

Kamilisha works for a wide range of transactions including:

- Bill payments (i.e., KPLC pre-paid tokens purchase)

- Send Money (i.e., Send money to M-Pesa Wallet)

-

When you’re making a payment and don’t have enough funds:

- You’ll receive a prompt asking if you want to complete the transaction using Kamilisha.

- The system shows you how much you need, and the fees required.

- If you agree, your transaction goes through immediately.

- You’ll get a confirmation SMS with your transaction details.

N/B: There’s no separate application process – it happens seamlessly during your transaction.

-

The pricing is straightforward:

- One-time access fee – 2% of the amount you borrow (charged upfront when you use the service).

- One-time Excise duty*

- Daily maintenance fee – 0.2% per day on your outstanding balance.

- Insurance – 0.034% per month (credit life insurance, recovered upfront).

For example, if you borrow KES 1,000.00, the following charges shall apply:

- An access fee of KES 20.00

- Excise duty of KES 4.00*

- Insurance fee of KES 0.35

- A daily charge of KES 2.00 on any outstanding balance

*Excise duty is charged in accordance with applicable tax laws.

-

The access fee, excise duty and insurance are deducted immediately when you use the service. The daily interest charge is calculated on your outstanding balance at the end of each day and recovered when funds are available in your account.

-

Repayment is automatic and hassle-free. Any money you receive or deposit into your Co-op Bank account is automatically used to pay off your Kamilisha outstanding balance. This includes the following:

- Salary deposits.

- Customer payments.

- M-Pesa transfers to your bank account.

- Deposits at branches or Coop Kwa Jirani Agents.

- Any other credits to your account.

-

- Salaried customers -Maximum of 30 days

- Business customers – Maximum of 15 days

However, we encourage you to repay as soon as possible to minimize daily charges. You can repay partially or in full at any time.

-

If you have an outstanding balance after the repayment period, you won’t be able to access new Kamilisha funds until you clear your balance. Your limit will be restored once you’ve fully repaid what you owe.

-

Absolutely! You can opt back in at any time by following the same enrolment process. Your eligibility and limit will be reassessed based on current criteria.

-

Yes, Kamilisha can run alongside other E-Credit products(Salary Advance & Business Plus etc., ). However, you cannot access Kamilisha if you have any E-Credit facility currently in arrears. Clear your arrears first, and your Kamilisha access will be restored.

-

Like any credit facility, your repayment behavior matters. Timely repayments can improve your standing with the bank and potentially increase your limits. Late payments may affect your ability to access Kamilisha and other credit facilities.

-

Common reasons include:

- You haven’t opted into the service.

- Your account is overdrawn irregularly.

- You have arrears on other bank facilities.

- Your CRB status doesn’t meet requirements.

- The transaction type isn’t supported by Kamilisha.

- You’ve exceeded your approved limit.

- Your account type isn’t eligible (e.g., joint accounts, savings accounts, minor accounts).

-

Security tips & Best practices:

- Never share your PIN with anyone.

- Monitor your account regularly for any unusual activity.

- Report any suspicious transactions immediately.

- Borrow only what you need.

- Repay as soon as you can to minimize charges.

- Keep track of your outstanding balance.

- Maintain good account performance for higher limits.